News

Analysis on market status and development trend of global fertilizer industry in 2021

According to the International Fertilizer Association (IFA), the global fertilizer consumption will increase by 2% to 193.5 million tons in 2020. It is expected that the global fertilizer consumption will further increase by 1.1% in 2021. However, the problem of global fertilizer oversupply continues, in which the oversupply of phosphoric acid will be alleviated, the oversupply of potassium salt will be further aggravated, and the oversupply of nitrogen will continue to be high, which is expected to reach 8.3 million tons of excess capacity in 2021.

The world's fertilizer production is concentrated in Asia, North America and Europe, accounting for more than 90% of the total global fertilizer production. Among them, East Asia, North America, South Asia and Eastern Europe are the main fertilizer production areas. China in eastern Asia, India and Pakistan in South Asia, the United States and Canada in North America, Russia and Belarus in Eastern Europe are typical representatives of the world's fertilizer producers.

Since Asia overtook North America as the world's largest major fertilizer producer in the late 1990s, the overall distribution of the world's fertilizer production region has remained unchanged in recent years. Asia has always been the largest fertilizer production region in the world, North America ranks second, followed by Europe, followed by Africa, South America and Oceania.

Further growth in global market demand

In novel coronavirus pneumonia, the global demand for fertilizer remained on the rise in 2020, according to the International Fertilizer Association (IFA). The main factors affecting the global demand for fertilizer were the government's active measures, the resilience of crop prices, the more attractive relationship between crops and fertilizer prices, the weakening of the currencies of large agricultural exporters, and the good weather conditions of major consumer countries. In addition, some farmers may buy Fertilizer earlier than usual to prevent possible delivery delays or financial difficulties.

IFA predicts that global fertilizer consumption will increase by 2% to 193.5 million tons in 2020, of which phosphate (P2O5) consumption will increase by 3%, nitrogen (n) will increase by 1.6%, and potassium (K2O) will increase by 1.4%; Global fertilizer use will increase by 1.1% in 2021, far lower than the growth level in 2020.

Among them, South Asia will continue to promote the expansion of global fertilizer use, followed by Eastern Europe, Central Asia, Latin America and Africa. In relative terms, the fastest growing markets will be Eastern Europe, Central Asia and Africa, followed by South Asia.

Table 1: global fertilizer demand in 2017-2021 (unit: 100 million tons,%)

The excess supply of phosphoric acid will be alleviated

The global production and use of phosphate fertilizer are mainly high concentration monoammonium phosphate and diammonium phosphate. The production of monoammonium phosphate is relatively concentrated, and the global production capacity is mainly concentrated in enterprises in China, the United States and Russia; On the one hand, the production capacity of diammonium phosphate is concentrated in China, India and the United States, which are major demand countries for phosphate fertilizer. At the same time, relying on the distribution of phosphate rock resources, Morocco, Saudi Arabia, Mexico and other countries are also major suppliers of phosphate fertilizer in the world. Phosphate rock resources are rich and of good quality, and the market share has been increasing in recent years.

According to the data released by IFA, the global output of processed phosphate fertilizer (map, NPs / MES, DAP and TSP) is expected to remain unchanged at 33.5 million tons of P2O5 (68 million tons of products) in 2020.

In 2020, the global total phosphoric acid supply will be 50.7 million tons of P2O5, an increase of 700000 tons of P2O5 over 2019. It is estimated that the global total phosphoric acid supply will be 51.2 million tons of P2O5 in 2021; It is estimated that the global demand for all-purpose phosphoric acid will be 49.3 million tons of P2O5 in 2021, compared with 47 million tons of P2O5 in 2019, with an annual growth rate of 2.4%.

Figure 2: Global phosphoric acid supply and demand from 2019 to 2021 (unit: million tons P2O5)

The excess supply of potassium salt is further aggravated

The global production of potash fertilizer is relatively concentrated, mainly distributed in the United States and Canada in North America, Russia and Belarus in Eastern Europe, and China in Asia, accounting for more than 80%.

According to IFA estimates, after the global production of potash decreased (- 3.3%) in 2019, with the improvement of market fundamentals and the increase of potash demand, the global primary potash production will rise slightly by 0.8% to 42.1 million tons of K2O in 2020.

Between 2019 and 2021, the global potash supply is expected to increase by 5% (+ 2.5 million tons of K2O) and reach 50.1 million tons of K2O by the end of 2021. It is estimated that global potash demand (including fertilizer use and industrial consumption) will expand by 1.2% and 1.7% respectively in 2020 and 2021.

By 2021, the global demand for potassium salt is expected to reach 42.9 million tons of K2O. It is expected that the global potassium salt imbalance will continue to expand in 2021 (reaching 7.3 million tons of K2O by the end of 2021). This level is equivalent to 14% of the global potential supply. Because the super large new capacity projects in Eastern Europe and Central Asia (Russia and Belarus) will bring a lot of potential supply, the global potash market will remain supply led in the near future.

Figure 3: global potash supply and demand from 2019 to 2021 (unit: million tons of K2O)

Excess nitrogen supply and continuous high pressure

At present, China has surpassed the United States to become the world's largest nitrogen fertilizer producer. The United States ranks second in the world, followed by India and Russia. The output of nitrogen fertilizer in these four countries exceeds half of the total output of nitrogen fertilizer in the world.

According to IFA data, in 2020, the global nitrogen supply increased significantly (by 2.3 million tons n) and the demand increased moderately (by 1.2 million tons n). Compared with 2020, the global nitrogen balance is expected to remain stable in 2021, with a potential surplus of 8.3 million tons of n.

This upcoming imbalance, equivalent to 5% of the potential supply in 2021, will put pressure on high-cost producers (or producers with long-term shortage of raw material supply), which will be conducive to operators with sustainable competitive advantages in resources and market access.

Figure 4: global nitrogen supply and demand from 2019 to 2021 (unit: million tons n)

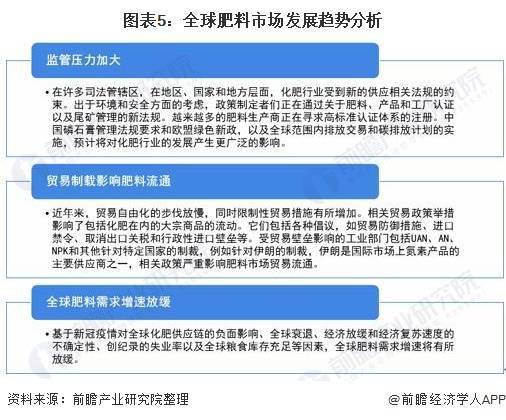

Development trend of global fertilizer market

Based on the current global COVID-19 and the economic situation, the growth of the global fertilizer market will slow down in the future, and the regulatory pressure will further increase. The relevant trade policies will affect the global fertilizer circulation.

Figure 5: analysis of development trend of global fertilizer market

(source: prospective industry research institute)